Sansera Engineering : Born To Win On Twitter The Team At Sansera Engineering Pvt Ltd Plant 9 Bangalore Is All Set For The Winning Journey Newgenerationwinners

Sansera Engineering IPO is a main-board IPO of 17244328 equity shares of the face value of 2 aggregating up to 128298 Crores. Sansera Engineering Limited CINU34103KA1981PLC004542 Registered Office.

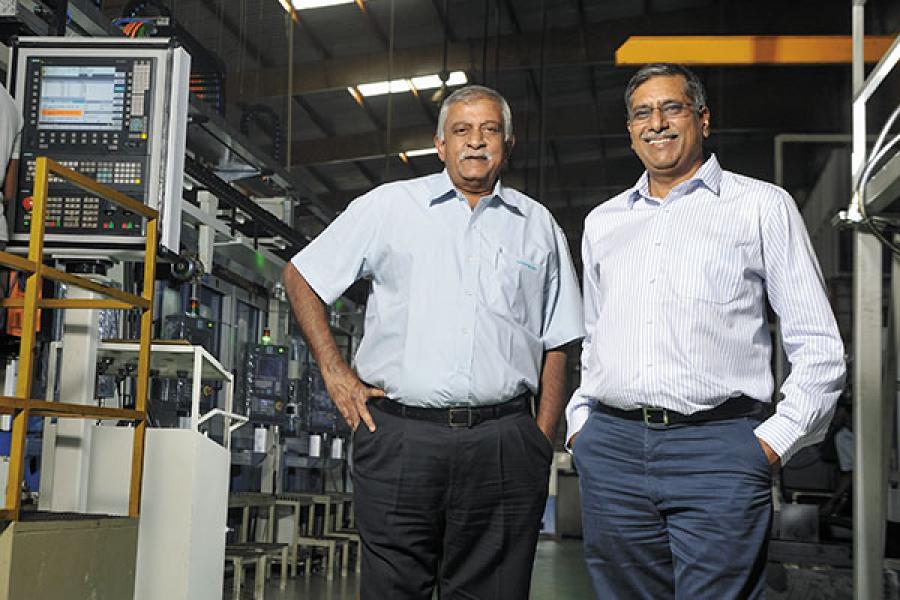

Sansera Engineering Succeeds On Quality Sustenance Auto Components India

The company to raise 1283 crores via IPO at a price.

Sansera Engineering. The Bengaluru-based firm is an engineering-led integrated manufacturer of complex and critical precision engineered components across automotive and non-automative sectors. An Engineering-led Integrated manufacturer Top class engineered components manufactured precisely to meet the. 91 80-27839309 E-mail id.

The stock listed at Rs 8187 apiece a 10 premium to its IPO price of Rs 744 according to data available on the bourses. Stringent demands of automotive segment AUTOMOTIVE Browse Our Automotive Components Supremely designed and resilient non-automotive components adhering to. Sansera Engineering IPO GMP is going down due to less demand in the grey market and stable between 40-50 range.

Shares of Sansera Engineering on its stock market debut listed at 811 on the NSE from its IPO issue price of 744 per share later surging to 830 apiece in minutes after opening for. Sansera Engineering manufactures complex and critical precision engineered components and caters across automotive and non-automotive sectors. Sansera Engineering shares traded at Rs 784-789 in the grey market a 54-6 percent premium over the issue price of Rs 744 per share according to IPO Watch and IPO Central data.

Sansera Engineering Limited CINU34103KA1981PLC004542 Registered Office. So far on the first day of bidding Sansera Engineering IPO. 91 80-27839309 E-mail id.

Sansera Engineering is a Bengaluru-based integrated manufacturer of complex and critical precision-engineered components across automotive two. Shares of Sansera Engineering Ltd. 143A Jigani Link Road Bommasandra Industrial Area Bangalore-560 105 Karnataka India Tel.

Link Intime India Private Ltd is the registrar for the IPO. June 11 2021 by profitmust. The Cap price for Sansera Engineering IPO is 744Estimated listing price for Sansera Engineering IPO as of current GMP is 779Expected gainloss per share in terms of percentage is 470.

Bengaluru based Sansera Engineering is coming up with IPO that would open for subscription on 14th September 2021. About Sansera Engineering Limited. Sansera Engineering IPO to hit the market on 14 September 2021.

The retail portion of this IPO is 35 QIB is 50 and HNI is 15 quota. 143A Jigani Link Road Bommasandra Industrial Area Bangalore-560 105 Karnataka India Tel. The IPO opens on Sep 14 2021 and closes on Sep 16 2021.

Sansera Engineering IPO Sansera Engineering Limited IPO Details. The highest standards of excellence and complexity NON AUTOMOTIVE. They are constantly working to improve their business processes and governance while also meeting their.

The company Sansera Engineering to raise around 1283 crores via IPO Offer for Sale - OFS Only. 91 80-27839309 E-mail id. Sansera Engineering IPO Subscription Status Live Numbers Final Data Sansera Engineering IPO subscription to start from September 14 2021 Tuesday.

The IPO got a good subscription on the last day as there was less trading in the grey market. 143A Jigani Link Road Bommasandra Industrial Area Bangalore-560 105 Karnataka India Tel. The Sansera Engineering IPO GMP is 35-5The IPO current GMP price last updated on Sep 22nd 2021 0915 AM.

Sansera Engineering IPO to list on NSE and BSE on 24 September 2021 Friday at 1000 AM. Sansera Engineering IPO. The IPO subscription will close on September 16 2021 Thursday.

Gained on market debut after its Rs 1283-crore initial public offering was subscribed 1147 times. The issue is priced at 734 to 744 per equity share. Sansera Engineering IPO Subscription Details Day by Day Sansera Engineering IPO subscribed 1147 timesSansera Engineering IPO received bids for 315 times issue size in retail 2647 times issue size in QIB and 1137 times issue size in the.

The IPO subscribed 1147 times in that Qualified Institutional Buyer QIB 2647x Non-institutional Bidders NII 1137x and Retail RII 315x. Sansera Engineerings Rs 1283-crore IPO initial public offering has opened for subscription and will close on 16 September 2021. Within the automotive sector the company manufacture and supply a wide range of precision forged and machined components and assemblies.

Sansera is driven by innovative production and takes responsibility for producing high-quality high-value-added goods that are produced utilising cutting-edge technology. Sansera Engineering Limited CINU34103KA1981PLC004542 Registered Office. The minimum order quantity is 20 Shares.

Born To Win On Twitter The Team At Sansera Engineering Pvt Ltd Plant 9 Bangalore Is All Set For The Winning Journey Newgenerationwinners

Sansera Engineering Succeeds On Quality Sustenance Page 4 Of 4 Auto Components India

Making It Big Season 7 Ep 5 Sansera Engineering Youtube

Sansera Engineering Pvt Ltd Chakan Pune Maharashtra Home Facebook

Sansera Engineering Limited Careers And Current Employee Profiles Find Referrals Linkedin

Sansera Engineering Files Drhp With Sebi

Sansera Engineering Pvt Ltd Gewis

Sansera Engineering Files Drhp With Sebi For Ipo Without Fresh Issue

Auto Ancillary Company Sansera Engineering Debuts On The Bourses Today Here Are The Details

Sansera Engineering Ipo Subscription Status Sansera Engineering Ipo Subscribed 11 47 Times On Final Day Led By Qibs Non Institutional Investors

Sansera Engineering Siemens Digital Industries Software

Sansera Engineering Pvt Ltd Gewis

Sansera Engineering Pvt Ltd Jigani Link Road Engineering Companies In Bangalore Justdial

Sansera Engineering Ipo News Sansera Engineering Ipo Dates Price Band Ipo Price All You Need To Know Sansera Engineering Ipo

Sjim Top Mba Pgdm Colleges In Bangalore Best Mba Colleges In Bangalore

Sansera Engineering Staying Afloat In A Volatile Industry Forbes India

Business Line On Twitter Sansera Engineering Files Ipo Papers With Sebi Https T Co Gaoqmbyhuz